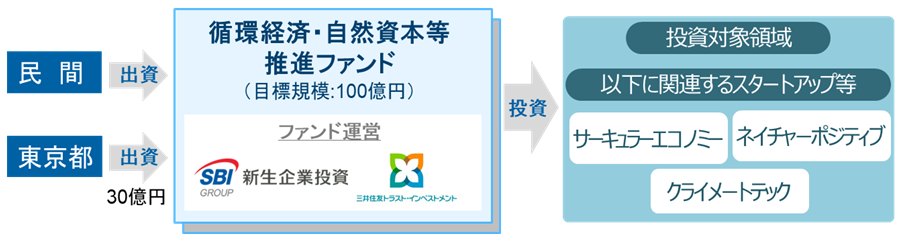

Tokyo Metropolitan Government has established the “Circular Economy and Natural Capital Promotion Fund” to support a sustainable, resource-efficient society, targeting carbon reduction goals of 50% by 2030 and net zero emissions by 2050. The selected fund operators, Shinsei Corporate Investment and Sumitomo Mitsui Trust Investment, will aim to promote circular economy initiatives in Tokyo with a projected 3 billion yen investment from the government by the end of fiscal year 2023.

Tokyo’s New Fund Launched to Support Sustainable Initiatives

In a push towards a carbon-neutral future, Tokyo Metropolitan Government has launched the “Circular Economy and Natural Capital Promotion Fund.” This fund aims to reduce resource consumption and waste while fostering a circular economy to build a sustainable society.

The fund operators selected are Shinsei Corporate Investment and Sumitomo Mitsui Trust Investment. Shinsei Corporate Investment, part of the SBI Group, brings over 20 years of venture investment experience. Sumitomo Mitsui Trust Investment, with its extensive network of corporate, regional, and academic connections, will support the fund’s investment processes alongside a team of circular economy experts.

The fund will support circular economy projects such as recycling lithium-ion batteries, plastics, biomass utilization, refurbishing electronics, and sharing services that maintain product value. It will also encourage projects contributing to nature-positive goals by preserving and restoring ecosystems.

Tokyo’s “Circular Economy and Natural Capital Promotion Fund” aligns with the city’s “Future Tokyo” strategy, which includes initiatives like the “Earn Tokyo” innovation strategy, “Water and Green Abundant Tokyo” strategy, and the “Zero Emission Tokyo” strategy. This fund reflects Tokyo’s commitment to long-term sustainable development by supporting both circular economy and nature-positive initiatives, and contributing to the establishment of a resilient, sustainable society for future generations.

Since May, Tokyo has invited applications for fund operators, conducted due diligence on candidates, and held a selection committee review in September.